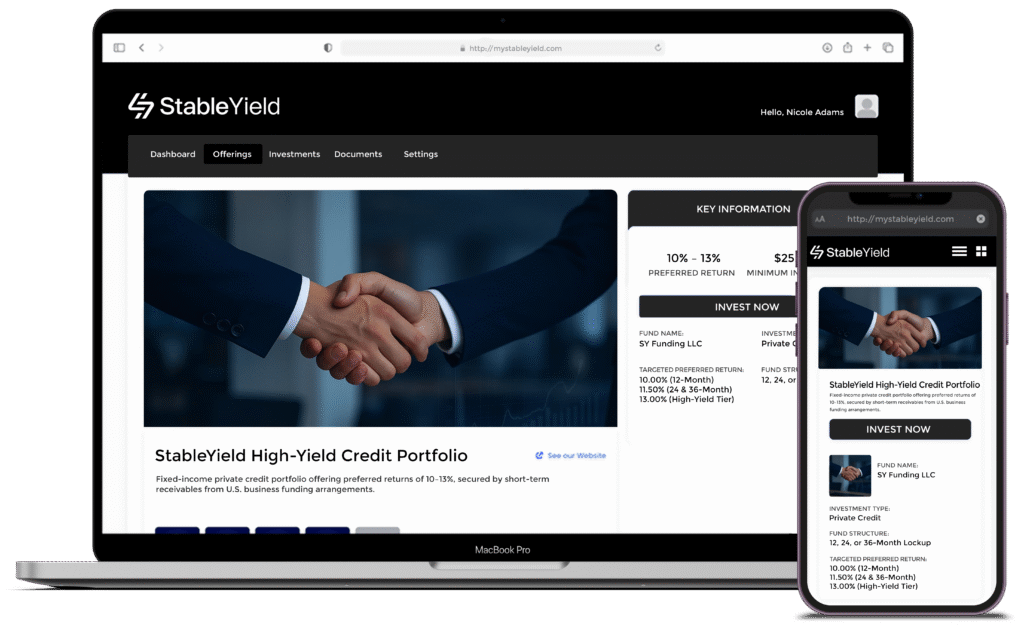

A Smarter Approach to Fixed Income

StableYield offers accredited investors access to institutional-grade private credit strategies with fixed yields and transparent terms.

What We Invest In

We allocate capital into short-duration merchant cash advances (MCAs) and private credit deals originated by trusted, vetted partners. These are short-term financing arrangements where small businesses receive upfront capital and repay via fixed remittance schedules — typically over 6 to 12 months.

These deals have historically generated 200–300% gross annualized book returns, giving us room to offer fixed yields of 10.39%–11.49% APY to investors — while capturing upside via backend performance.

Why This Strategy Outperforms Bonds and CDs

Why Private Credit Works

How StableYield Generates Fixed Returns

From Investor Capital to Fixed Yield

01

Investor subscribes to 12–36 month note

02

Capital pooled and deployed into dozens of MCA deals

03

Daily/weekly payments collected from borrowers

04

Investor receives fixed yield at maturity (APY)

05

Any upside beyond fixed yield is retained by the fund

Risk-Aware. Not Risk-Blind.

- Diversification across dozens of deals

- Partner only with vetted MCA originators

- Conservative position sizing

- Liquidity buffer and rolling capital deployment

- Quarterly portfolio reviews and reporting

Your Fixed Yield Options

12 Months

24 Months

36 Months

All offerings available to accredited investors only under SEC Reg D 506(c).

Ready to Earn Fixed Income with Confidence?

Secure your allocation in StableYield Fixed Income Fund I, LLC.

Join our next investor round before capacity fills.